New research by Vote Leave reveals:

- The EU has made no secret of its plans to abolish the UK’s zero and reduced rates of value added tax (VAT).

- Official figures from the Commissioners for HM Revenue and Customs (HMRC) show that the revenue raised if these lower rates did not exist would have been £71.3 billion in 2015-2016. This would constitute an effective 61.5% rise in VAT, or a 10.5% increase in the total tax burden.

- This amounts to £2,649 per household and suggests that the EU’s continued control of the UK’s tax system could prove very costly in the event of a ‘remain’ vote on 23 June.

Commenting, John Redwood said:

‘VAT is an EU tax, and the EU is always keen to control it more firmly. Doubtless in the future they will want to tax us more - and will use VAT to do so. The latest consultation is on centralising the tax, with no mention of the UK’s wish to abolish the tampon tax or VAT on fuel, policies which are against EU law today. Tomorrow EU law might make us put up VAT on various necessities of life.’

Vote Leave Chief Executive Matthew Elliott added:

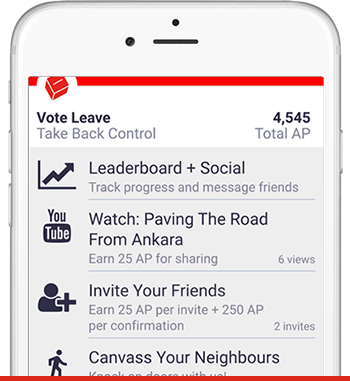

‘We should have the power to set our own tax rates in this country rather than being told what to do by the EU. It is an affront to democracy and it directly impacts on British families - with their latest plans set to cost every household more than £2500. That’s on top of the £350 million we send to the EU every week. The only way to take back control is to Vote Leave on Thursday.’

The EU’s hostility to reduced rates of VAT

The European Union has consistently argued that reduced or zero rates of value added tax (VAT) are inconsistent with the ‘single market’. In the 1985 White Paper which launched the ‘single market’ programme, the Commission stated that ‘there are strong arguments in favour of a single rate’ of VAT (European Commission, 14 June 1985, link). A 2010 Green Paper advocated 'a broad based VAT system, ideally with a single rate'. It stated: ‘Exemptions are contrary to the principle of VAT as a broad based tax. The continued relevance of many of the existing exemptions is questionable. Broadening the tax base by reducing the number of exemptions makes the tax more efficient and more neutral’ (European Commission, December 2010, link).

The Commission’s views have not changed. In January this year, the Economics Commissioner, Pierre Moscovici, called for further harmonisation of taxation, including scrapping the UK’s zero rates, stating a ‘zero rate is not the best idea’ (Guardian, 28 January 2016, link).

The consequences of scrapping reduced and zero rates

The Commissioners for Her Majesty’s Revenue and Customs (HMRC) publish statistics on the ‘estimated costs of the principal tax expenditure and structural reliefs’ for major taxes, including VAT. These figures provide an estimate of the amount of tax revenue that HMRC would raise if the exemptions or reliefs were abolished. The table shows the figures for major items which are zero rated, subject to the reduced rate, or are exempt from VAT.

|

Estimated costs of the principal VAT expenditure and structural reliefs (2015/2016) |

|

|

Relief |

Value (£m) |

|

Zero rating of goods and services |

|

|

Food |

£17,400 |

|

Construction of new dwellings |

£11,400 |

|

Domestic passenger transport |

£4,750 |

|

International passenger transport |

£350 |

|

Books, newspapers and magazines |

£1,700 |

|

Children’s clothing |

£1,950 |

|

Water and sewerage services |

£2,300 |

|

Drugs and supplies on prescription |

£3,400 |

|

Supplies to charities |

£300 |

|

Certain ships and aircraft |

£450 |

|

Vehicles and other supplies to disabled people |

£900 |

|

Subtotal |

£44,900 |

|

Reduced rating of good and services |

|

|

Domestic fuel and power |

£4,800 |

|

Certain residential conversions and renovations |

£300 |

|

Energy saving materials |

£100 |

|

Subtotal |

£5,200 |

|

Exempt transactions |

|

|

Rent on domestic dwellings |

£4,600 |

|

Supplies of commercial property |

£200 |

|

Education |

£3,950 |

|

Health Services |

£3,200 |

|

Postal services |

£150 |

|

Burial and cremation |

£250 |

|

Finance and insurance |

£5,300 |

|

Betting and gaming and lottery duties |

£1,900 |

|

Small traders below the turnover limit for VAT registration |

£1,600 |

|

Subtotal |

£21,150 |

|

Grand Total |

£71,250 |

Source: HMRC, December 2015, link.

The table shows that the total amount of revenue that would be raised if these reliefs were scrapped would have been £71.3 billion in 2015-2016. This would amount to an increase in the revenue collected from VAT of 61.5%, or a 10.5% rise in total taxes (HM Treasury, March 2016, link). It is possible to calculate the burden that would fall on each household if the reliefs were scrapped.

|

Cost of abolishing reliefs |

|

|

Total cost of reliefs (£m) |

£71,250 |

|

Number of households (million) |

26.994 |

|

Total per household (£) |

£2,639 |

Source: HMRC, December 2015, link; ONS, November 2015, link.

The table shows that an additional tax burden of £2,639 would fall on each household in the event that the UK’s major VAT reliefs were scrapped.