Briefing

How silly EU regulations cost billions and harm small businesses, jobs, and safety

Get InvolvedTHE EU HAS TOO MUCH CONTROL

There are many silly EU rules that don’t have a very big effect and there are many that are silly, damaging, and expensive for families, small businesses, and public services. We cannot list all of them, there are thousands, but here is a selection to give a flavour of how much the EU now controls and how silly and damaging this can be.

Under EU rules, the following cannot be changed by the British Parliament or courts:

EU laws on testing cancer drugs that have caused severe delays and drug price rises.

The EU controls the export of live animals and forbids restrictions by the UK.

Legal obligations on housebuilders which the Government admits stop the UK ‘building the homes that Britain needs’.

Rules on ‘public procurement’ add millions of pounds and months of delays to vital public service building projects.

The Government must charge VAT on tampons, condoms and energy bills. VAT is an EU tax - we were forced to introduce VAT by the EU and the EU doesn’t allow us to scrap it or even cut VAT rates without their approval.

Rules on the maximum energy of appliances like vacuum cleaners - kettles and toasters are next on the Commission’s agenda after our referendum.

The Government admits that rules on pesticides stop British farmers using ‘innovative crop protection products’ but there is nothing we can do about it.

Rules on genetically modified crops.

Rules on chemicals and waste do little for safety but add to costs for small businesses, which harms jobs.

Olive oil may never be sold to consumers in containers bigger than 5 litres.

Food sellers have to put warning labels on all fish products saying ‘may contain fish’.

Wholesalers cannot import bananas in hands of two or three fingers or bananas that have ‘abnormal curvature of the fingers’.

EU legislation, in the form of directives, regulations and decisions, has ultimate authority over the law of the EU member states. If the EU institutions introduce a law, the UK Government and Parliament have to accept it. The most Britain can do is challenge it in the European Court of Justice, but a) it takes years, b) we usually lose, c) the ECJ itself decides on the power of the ECJ and other EU institutions and almost always decides cases in such a way as to increase the EU’s power, and d) there is no appeal. The European Court has also ruled that it is illegal to exempt small businesses from damaging regulations that they cannot afford to meet.

The total cost of EU regulation on British business has been estimated at over £30 billion per year, or £600 million per week. About 68% of this comes from ‘Single Market’ regulations.

It is vital to realise that Single Market rules are used by the Commission to extend EU power into many fields that have nothing to do with free trade, such as trials of cancer drugs. Many of the most damaging EU rules are Single Market regulations. Free trade, classically understood, does not need the dense web of product and other regulations that the Single Market involves. The reason for the latter is of course that the Single Market has always been seen by the Commission as a political project to extend the power of the EU, not a free trade project. Only in the UK do elites pretend the Single Market is ‘about free trade’.

SILLY REGULATIONS

Olive Oil Legislation (Regulation 2012/29/EU). ‘In order to guarantee the authenticity of the olive oils sold’, this regulation provides that olive oils ‘shall be presented to the final consumer in packaging of a maximum capacity of 5 litres’. This is a Single Market regulation and is a good example of how the Single Market is used to pass rules that restrict trade rather than enable it. Classic free trade deals do not involve such restrictive rules.

The Ecodesign Regulation (Regulation 2013/666/EU). This implements EU rules that enforce power levels for vacuum cleaners. A similar rule (Regulation 2014/66/EU) controlled the amount of power that ovens are allowed to use. It is very likely that these standards will soon be extended to British kettles and toasters.

European Food Information to Consumers Regulation (Regulation 2011/1169/EU). This imposes silly requirements for labelling. For example, it obliges shops to attach warnings on their fish products stating that their products may contain fish.

Nutrition and Health Claims Regulation (Regulation 2006/1924/EC). Under this regulation, the European Food Safety Authority declared that it was illegal to say that drinking water stops dehydration.

The ‘Bendy Bananas’ Regulation (Regulation 2011/1133/EU). It is often claimed that this infamous rule is a myth. It is not. This Regulation provides that bananas ‘must be … free from ... abnormal curvature of the fingers’. It also prevents bananas being imported in hands of two or three fingers.

VERY DAMAGING REGULATIONS

The Clinical Trials Directive (Directive 2001/20/EC). This Directive entered into operation in June 2005 and was intended to harmonise regulation of clinical trials. Academic studies concluded within eighteen months that it ‘resulted in a doubling of the cost of running non-commercial cancer clinical trials in the UK and a delay to the start of trials’ and ‘both increased the cost and caused delay to non-commercial cancer clinical trials run by major public sector Clinical Trials Units in the UK’. Between 2007 and 2011, applications for clinical trials fell by 25%. The cost of insuring commercial trials increased by 800% and the cost of administering non-commercial trials increased by 98%. Despite its obvious flaws, the Directive remains in force today. It is being repealed by a regulation nearly seven times larger later this year.

EU public procurement legislation (Directives 2014/24/EU, 2014/25/EU). This imposes complex tendering requirements for public contracts, such as having to advertise tenders in the EU’s Official Journal. A consistent complaint is that the threshold at which procurement law applies is set too low. Even the pro-EU UK Government has admitted it is damaging: ‘the rules are onerous, especially for SMEs. This leads to a regulatory “cliff edge” that inhibits SMEs from bidding for work above the threshold’ . A study for the European Commission found that procurement costs amounted to 30% of the value of a small contract and that procurement exercises cost £45,000 on average and delay contractual awards by 193 days.

These procurement rules are often supported by large companies because they make it much harder for entrepreneurs to compete. The UK Civil Service has responded to these rules by creating ‘Frameworks’ which all companies must follow to be compliant with EU law. These Frameworks make everything take longer and make applying for a contract so expensive that very few small businesses even bother applying.

Michael Gove MP, former Secretary of State for Education, has talked about the effect of such regulations on the cost of building projects for public services such as schools. Huge amounts of money are wasted because of these rules. Projects such as vital housing projects are unnecessarily delayed.

REACH (Regulation 2006/1907/EC). This regulation makes provision for the Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH). The Government has admitted that:

‘The cost of registering chemicals under REACH is excessive. SMEs across the EU are hit disproportionately hard. REACH is forcing some smaller businesses to consider manufacturing outside Europe or stop manufacturing altogether. Current REACH guidance is unwieldy and complex. It forces small companies to buy in expertise to help them comply, which can cost €180 per hour. In 2018, the threshold for registration will reduce from 100 tonnes to one tonne per annum. Most SMEs will then be covered by the regime. They will have little option but to pay fees, often prohibitively high, to join ‘registration’ consortia to gain access to information on chemicals and register for REACH. Costs can be as high as €100,000. We have been given evidence of small firms being advised by their trade association not to grow so that they remain under the threshold. Such arrangements can result in small companies having to obtain information from larger competitors – an open invitation to disreputable larger companies to abuse their position to keep smaller competitors out of the market’.

The Waste Framework Directive (Directive 2008/98/EC). This Directive is intended to govern the management of waste by business. As the Government has admitted, ‘EU rules on the disposal of business waste place a significant burden on SMEs. Even low-risk SMEs such as gardeners, that transport only a small amount of their own waste, need to register as waste carriers. The time and administrative cost spent on doing this is disproportionate for SMEs’. The Government predicted that as many as 460,000 additional SMEs would have to register by 2014.

Health and safety assessments (Directive 1999/391/EEC). Lots of health and safety regulation is sensible but sometimes the EU goes far too far. As the Government has admitted: ‘The Health and Safety at Work Framework Directive requires all businesses to keep written records of risk assessments carried out in their workplace, regardless of risk.’ The Government notes that this burden applies to 220,000 UK small businesses, and costs businesses across the EU an estimated €2.7 billion. The European Court has ruled that it is illegal to exempt small businesses, even those with fewer than ten employees, from this onerous requirement.

The Plant Protection Products Regulation (Regulation 2009/1107/EC). This regulation governs the use of pesticides in the EU. The Government has admitted that this ‘EU regulation denies business access to innovative crop protection products. This hinders EU businesses in their efforts to improve crop yields and quality. As a result, EU farming businesses are disadvantaged on world markets’.

The GM Food and Feed Regulation (Regulation 2003/1829/EC). Under this regulation, genetically modified (GM) organisms cannot be marketed in the UK without the approval of the European Commission. In 2007, BASF conducted field trials of a strain of GM potatoes, known as ‘Fortuna’, which were resistant to blight. After approval to market the ‘Fortuna’ series of potatoes was continually refused by the EU, BASF announced that continued investment in the strain would be halted due to ‘uncertainty in the regulatory environment’, subsequently moving its operations to the United States.

Resale Rights Directive (Directive 2001/84/EC). This directive creates a right under European Union law for artists to receive royalties on their works when these are resold (droit de suite). These have proven to be ruinously expensive. Jussi Pylkkänen, President of Christie’s Europe, recently called the ‘extension of the artists’ resale right to deceased European artists’ in 2012 ‘a matter of real concern. It will affect the modern art market, which is a key aspect of Christie’s activities in London’.

Protection of Animals during Transport and Related Operations Regulation (Council Regulation 2005/1/EC). This regulation entered into operation on 5 January 2007 and forbids the prohibition of the export trade of live animals. The EU Treaties in principle forbid ‘all measures having equivalent effect’ to ‘quantitative restrictions’ on the import and export of goods. In a seminal judgment in 1974, the European Court of Justice (ECJ) held that this prohibition extended to ‘all trading rules enacted by member states which are capable of hindering, directly or indirectly, actually or potentially, intra-[EU] trade.’

In March 1998, the ECJ held that a ban on the export of live calves from one member state to another was a measure equivalent to a quantitative restriction. It stated that because the Directive exhaustively harmonised animal welfare requirements, a ban on the live export of calves was inconsistent with EU law. Because of this, the United Kingdom Government has consistently taken the position that a prohibition on the export of live animals for slaughter is inconsistent with EU law .

Habitats Directive (Council Directive 1992/43/EEC). The Government has acknowledged that ‘EU rules such as the Habitats Directive and wider EU environmental permit requirements’ are regulations which stop housebuilders ‘building the homes that Britain needs’. Despite this admission, changing these EU rules formed no part of the Government’s renegotiation. The Home Builders Federation has said that the implementation of the Habitats Directive ‘brought house building activity to a virtual halt in large parts of some 11 local authorities in Berkshire, Surrey and NE Hampshire’ ten years ago, ‘leading to significant job losses in the home building industry and threatening the existence of many SME companies in the region’.

VAT Directive (Council Directive 2006/112/EC). Under the terms of this Directive, we are unable to lower VAT on many important goods and services. When the UK joined the EU in 1973 it had to introduce Value Added Tax (VAT). EU rules state the UK can only lower VAT below 15% on a handful of products and can charge 0% on an even smaller number of goods. Any other exemptions have to be approved by the EU. If the Government was unilaterally to create exemptions for specific goods or services beyond the items allowed, the consequences would be costly. In a recent case, the European Commission referred the Dutch Government to the European Court of Justice (ECJ) for allowing exemptions on boat moorings that had not been approved at EU level.

This means that the UK is forced to charge VAT on women’s sanitary products. Council Directive 2006/112/EC on the common system of VAT entered into force on 1 January 2007. This Directive requires that sanitary products must be subject to VAT, although Member states are permitted to charge a reduced rate of not less than 5% on ‘products used for contraception and sanitary protection’. However, they cannot charge 0% without the approval of the EU, since the Directive contains an exhaustive list of activities which must be or can be exempt from VAT. This list does not include sanitary products. It is concerning that, while essential products like sanitary products and energy bills aren't considered VAT-exempt, on 22 October 2015, the ECJ decided that the exchange of bitcoin (which is often used in illegal transactions) must be exempt from VAT .

The European Commission has on various occasions made clear its desire to eliminate zero and reduced rates of VAT. As recently as 2010, a green paper advocated 'a broad based VAT system, ideally with a single rate'. Another paper in 2011 stated ‘revenue would be increased if the Member States’ national VAT bases were broadened’ - i.e. the scope of zero or reduced rates diminished. The Economics Commissioner, Pierre Moscovici, has called for further harmonisation of taxation, including scrapping the UK’s zero rates, stating a ‘zero rate is not the best idea’. This means that there is a real prospect, in the near future, of calls for VAT rates being increased on sanitary products as part of an EU-wide push for VAT harmonisation.

The Weights and Measures Directive (Council Directive 1980/181/EEC). Under this Directive, the UK is obliged to use metric units. While the use of imperial measures as a ‘supplementary indicator’ is permitted, metric units ‘shall predominate’ and must be given in the same or a larger font than imperial measurements. While the UK is still permitted to use pints for draught beer, milk in reusable bottles, and miles on road signs, because this Directive was adopted by qualified majority voting, these narrow derogations could be abolished the day after the referendum in the event of a remain vote. Many traders have been prosecuted and ‘martyred’ for breaking this EU law.

Mortgage Credit Directive (Directive 2014/17/EU). According to the Financial Times, the requirement in the Directive on lenders to display more than one interest rate left borrowers liable to be ‘completely confused’. The Directive was also criticised as ‘redundant’ in the UK, where consumer protection was already strong.

THE REACH OF EU REGULATIONS

Nick Clegg, former Deputy Prime Minister and lobbyist for the EU and Goldman Sachs has admitted: ‘half of all new legislation now enacted in the UK begins in Brussels’. The EU-funded CBI has admitted that ‘over 50% of all government legislation originat[es] in Brussels’. It has also admitted that ‘70% of all new legislation relevant to business is now European rather than national in origin’. Pro-EU campaigner, Chuka Ummuna has admitted: ‘EU legislation… accounts for around half of all new regulation’.

The impartial House of Commons Library produced research recently suggesting that around 60% of law originates from the EU. The scope of EU law is now so vast that it is impossible to get an exact figure but it is clear that the power of the EU now is vast, getting bigger, and bears no resemblance to what is needed to help free trade and friendly international cooperation.

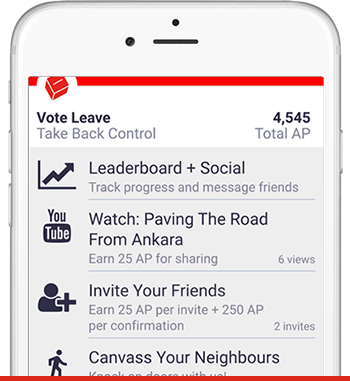

Vote Leave App

Together we can make a difference and win the referendum with grassroot support from campaigners like you.

Please get involved and take action by downloading the official Vote Leave mobile app and join tens of thousands of volunteers helping us take back control!